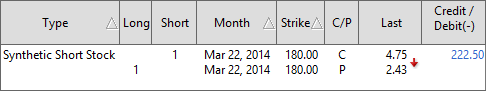

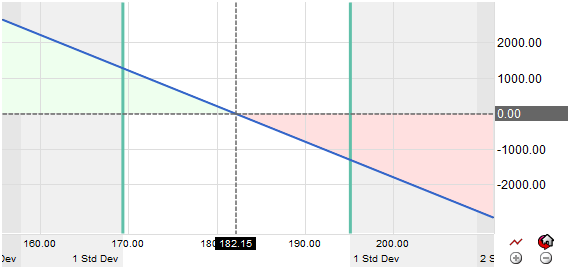

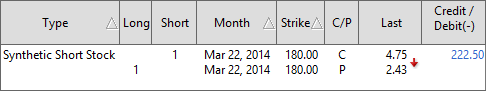

The Synthetic Long Stock Strategy is a bearish options strategy which simulates selling a stock (Short Stock) with the advantage of having a much lower upfront cost than simply shorting the stock outright. The trade is placed by simultaneously purchasing an At-The-Money Put and selling an equal amount of At-The-Money Calls, since the At-The-Money Puts are typically more expensive then calls this trade will typically have a credit when initiated. The strategy does carry a large amount of potential loss if the underlying stock turns bullish and should be followed aggressively with stops.