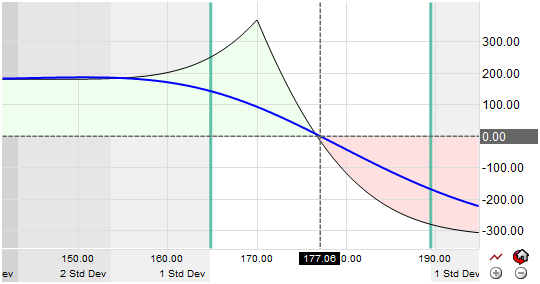

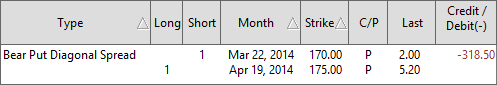

The Bear Put Diagonal spread strategy is a limited-risk, limited-reward play initiated by opening simultaneously long and short option put positions with different strike prices and expiration dates. It is similar to a calendar put spread in that it consists of two puts with different expirations, but differs from a calendar spread because the strikes differ. The long put expires after the short put. The position will profit if the underlying asset price declines. The short leg will decay faster than the long leg. The long leg can be sold when the short leg expires. This spread is useful when investors are predicting the asset or market will stay long term bearish.

Summary: A put diagonal spread involves options from different expiration months and with different striking prices, and is used as a way to generate income using controlled leveraging when the trader determines a market is bearish.