Preset Advanced Stock Filters

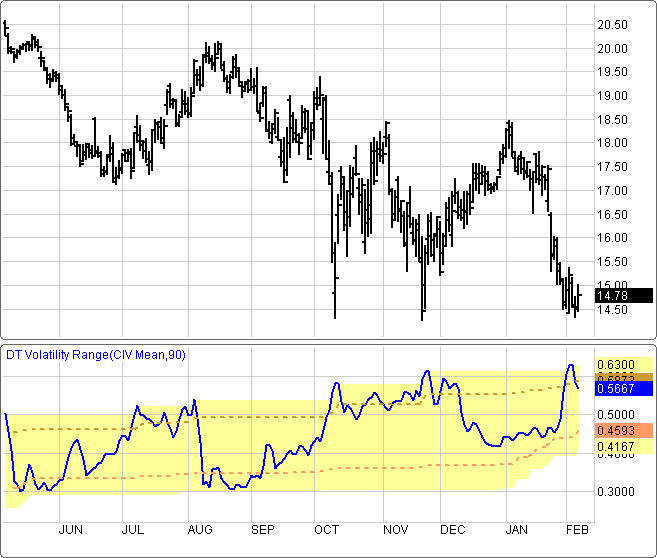

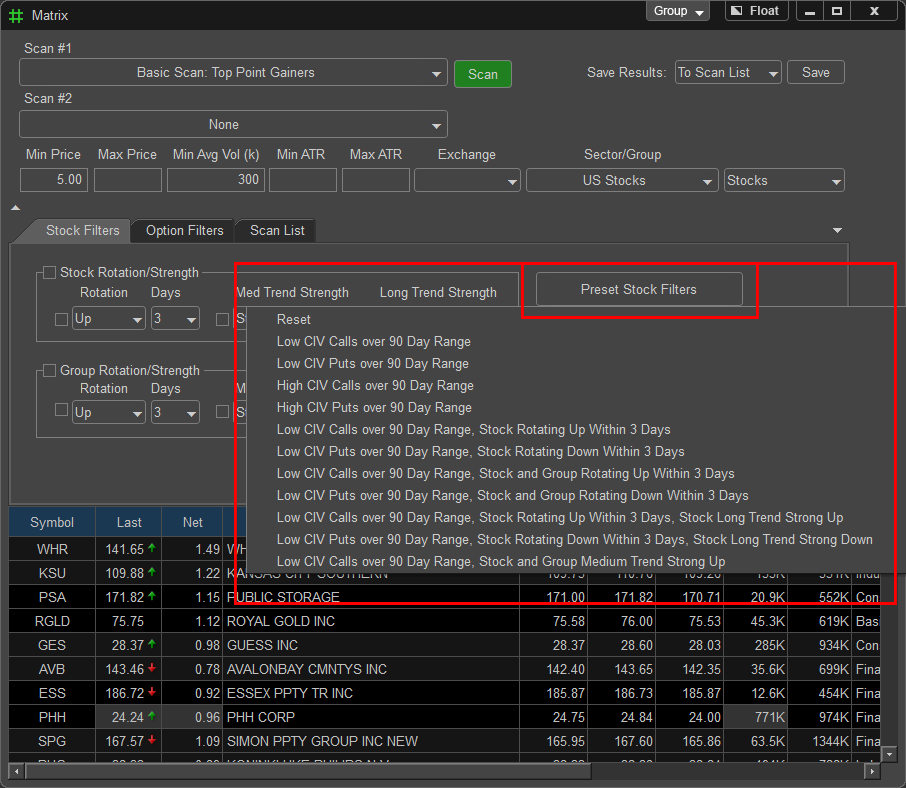

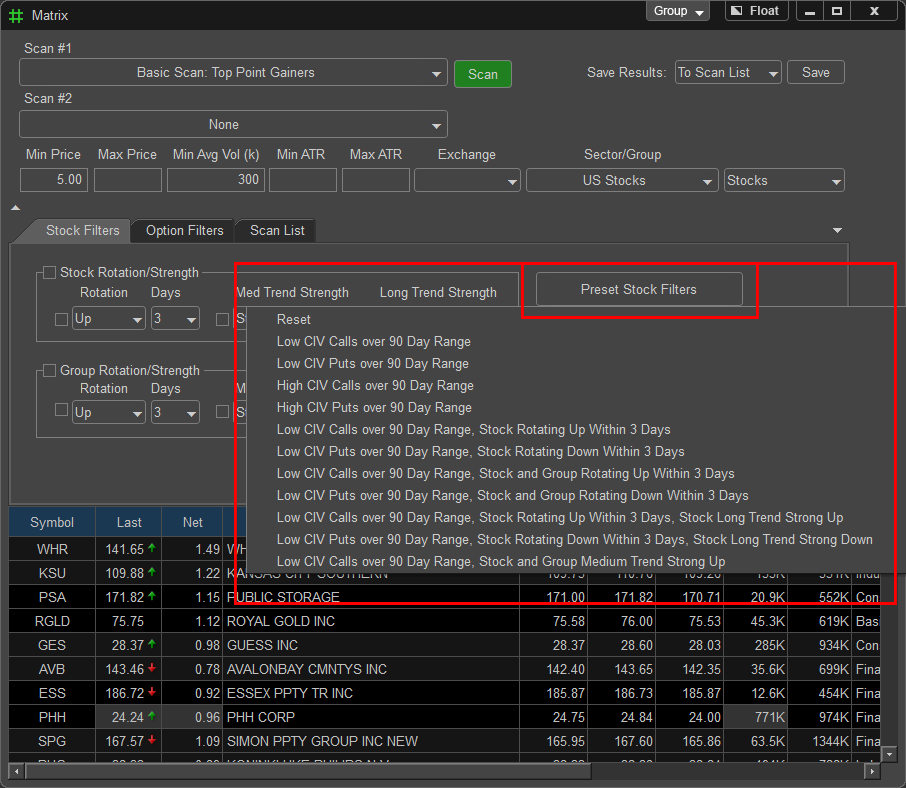

Low CIV Calls over 90 Day Range - This scan filter uses a Continuous Implied Volatility (CIV) data to identify a high/low range of the implied volatility over the last 90 days. Once the range is calculated, the scan identifies stocks that are currently trading below 20% of its CIV range, indicating longer options premiums compared to the last 90 days. User can also select lower look back periods or short periods such as a 20 day to calculate the CIV high/low range. If interested in buying a Call, a stock identified using this filter is said to be in a more reasonably priced option value.

Low CIV Puts over 90 Day Range - This scan filter uses a Continuous Implied Volatility (CIV) data to identify a high/low range of the implied volatility over the last 90 days. Once the range is calculated, the scan identifies stocks that are currently trading below 20% of its CIV range, indicating lower options premiums compared to the last 90 days. User can also select longer look back periods or short periods such as a 20 day to calculate the CIV high/low range. If interested in buying a Put, a stock identified using this filter is said to be in a more reasonably priced option value.

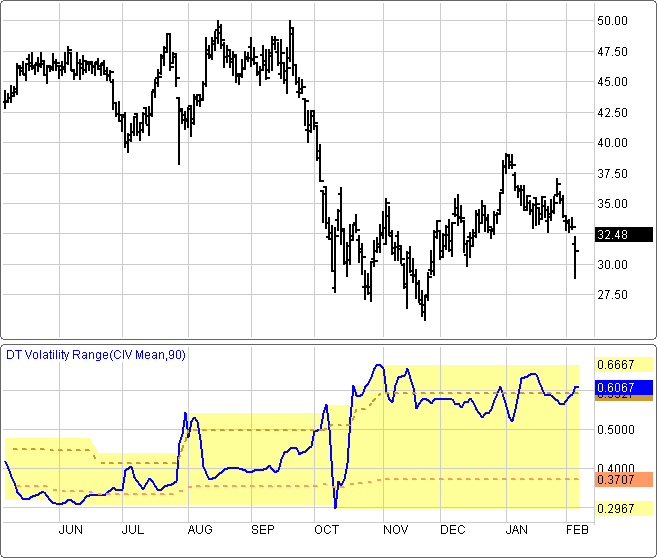

High CIV Calls over 90 Day Range - This scan filter uses a Continuous Implied Volatility (CIV) data to identify a high/low range of the implied volatility over the last 90 days. Once the range is calculated, the scan identifies stocks that are currently trading above 80% of its CIV range, indicating higher options premiums compared to the last 90 days. User can also select longer look back periods or short periods such as a 20 day to calculate the CIV high/low range. If interested in Selling a Call to collect the premium, a stock identified using this filter will have a higher, more expensive Call value so would qualify as a good candidate for this type of option strategy.

High CIV Puts over 90 Day Range - This scan filter uses a Continuous Implied Volatility (CIV) data to identify a high/low range of the implied volatility over the last 90 days. Once the range is calculated, the scan identifies stocks that are currently trading above 80% of its CIV range, indicating higher options premiums compared to the last 90 days. User can also select longer look back periods or short periods such as a 20 day to calculate the CIV high/low range. If interested in Selling a Put to collect the premium, a stock identified using this filter will have a higher, more expensive Put value so would qualify as a good candidate for this type of option strategy.